Both surveys conclude that consumers are simply not familiar with EVs -there is limited knowledge about availability of models, availability of incentives, vehicle technical features, and charging infrastructure availability.

While the FI survey proposes to launch federal marketing campaigns in order to increase awareness, the McKinsey insight underlines the importance for the car dealer to change from car sellers to trusted advisors, who interactively address consumer concerns, and provide advice using innovative methods (for which commercial and technical training becomes essential):

Some evidences of this gap of consumer know-how follow:

- Some consumers may perceive the driving range of EVs to be insufficient for their needs, whereas it’s been proven that for most commute distances, EV batteries fulfill largely their mobility needs.

- Even in areas where EV awareness is higher (McKinsey reported a level of consumer awareness of 92% in 2020), there is still some confusion among consumers between a conventional gasoline-electric hybrid vehicle and a PHEV.

- There is a perception of fewer EV models available and a knowledge gap among various dealerships, whereas there are everyday new models launched by car manufacturers.

REPORTED INTEREST IN EV DOES NOT ALIGN WITH CONSUMER PURCHASING PATTERNS.

Even in California, with some specific regions experiencing rapid growth, there is still a modest growth in EVs. A study conducted by the California Air Resources Board (CARB) concludes that, in this state, EV sales is not consistent across communities or neighborhoods but that households with higher incomes, higher housing values, higher rates of single-family housing, and access to residential charging opportunities tend to purchase EVs at a higher rate.

Moreover, McKinsey gave us an EV consumer’s profile that makes it a lot different from ICE’s: 5 years younger, live in urban areas, drives 32% longer commute time, earns 30% more and is six times more likely to have bought car online.

Perhaps it is time for the car dealers to adapt to this new customer profile.

As far as vehicle lease, while the FI study sees the high EV lease rates as a barrier to the mass EV adoption, for McKinsey, it is a way to adapt to the changing consumer preferences and to bring consumers more fully onboard.

There are a variety of concerted efforts to improve consumer awareness of EVs, and for EV enthusiasts there is often a scapegoat for lack of awareness. Some stakeholders have laid the blame for it on the lack of spending on advertising by major automakers, others on the lack of initiatives to push EVs by electric facilities. The fact is that consumer acceptance and awareness will improve incrementally over time with concerted efforts from market participants that can make a strong business case for supporting transportation electrification.

It is difficult to do more without implementing expensive measures that could produce tenuous results.

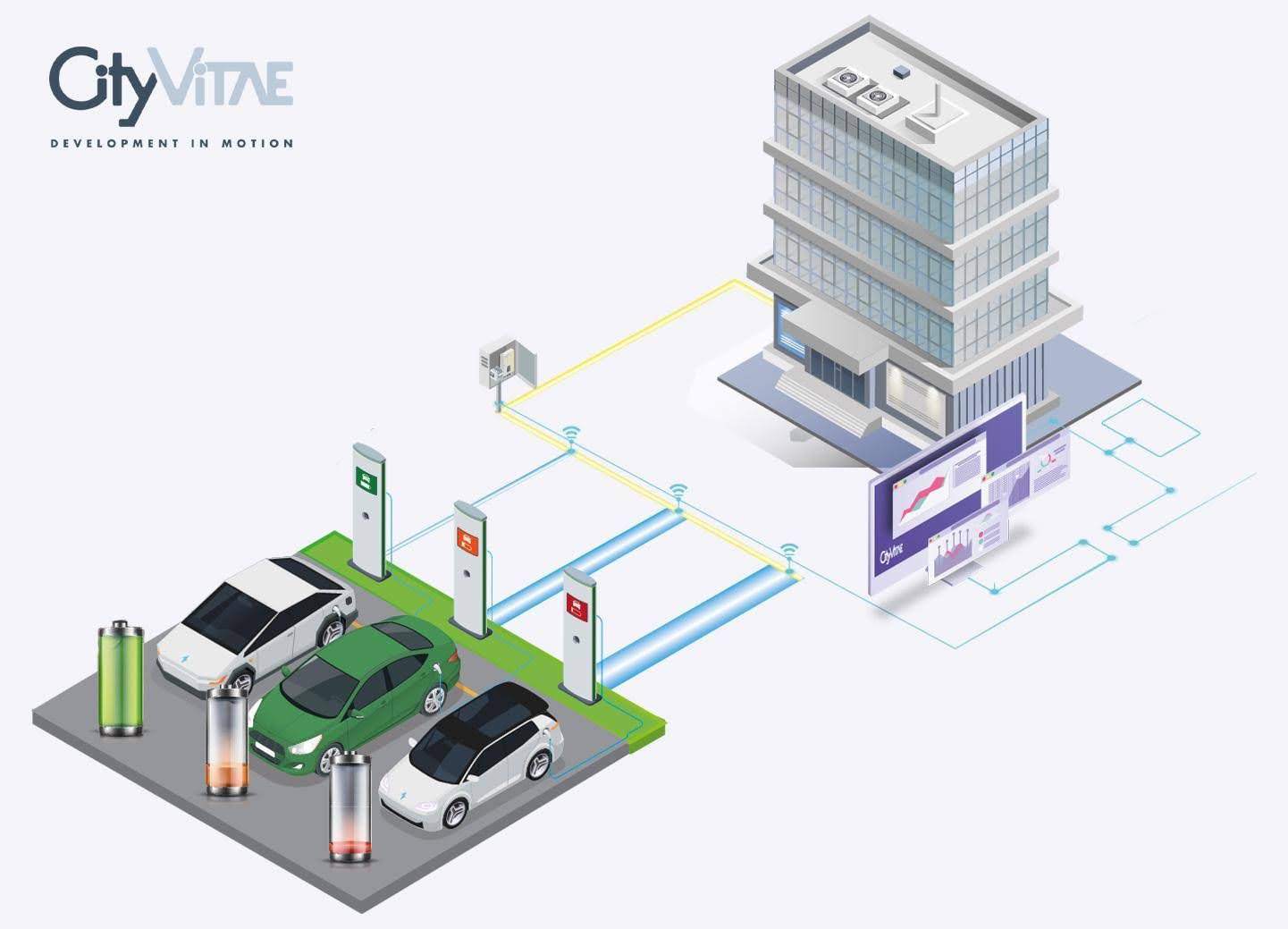

EV CHARGING INFRASTRUCTURE

Many of the surveys regarding consumer awareness have also highlighted the issues around availability of charging infrastructure and more precisely of public chargers. The lack of public chargers has often been (mis-)used as the biggest justification for the slow EVs adoption.

Higher range and shorter charging times increase the utilization of a charger up to factor 15X. With the rollout of ultra-fast chargers and the number of car batteries which can take up to 350+kW, less public stations will be needed in comparison to the number forecasted by experts and politicians.

About the main consumer concerns, the McKinsey survey concludes that the higher upfront costs of EVs, the availability of charging and the uncertainty around battery technology could be mitigated or solved by capable and well-trained dealers providing individual and tailored advise and know-how to customers, given their personal driving patterns.

In contrast, for the FI, EV pricing and driving range are essentially technology issues to be addressed by auto and battery manufacturers, and infrastructure availability is more of a planning and/or investment constraint that can be addressed by all the stakeholder community, with a focus on utilities, charging station providers, site hosts, and even government agencies.

CONCLUSION

Technology has never disappointed human beings. We know, for example, that efforts are being made to develop solid-state batteries that will increase energy density by several orders of magnitude. The first applications have been commercialized for military and space use.

Similarly, among the several million users of electric cars that already exist, there have been no reported dissatisfactions or problems with the behavior of the vehicle in a systemic way, which reduces the problem to how to convince more users rather than solve problems of existing users.

It seems that the EV revolution has no reverse gear and if the three major problems that exist to accelerate it are range, car price or our ability to convince more and more users, the battle is won before it starts.

McKinsey&Co., The Road Ahead, January 2020

The Fuels Institute, Electric Vehicle Adoption: Focus on Charging, June 2020

Anna Mª Francino, Business Development, CityVitae